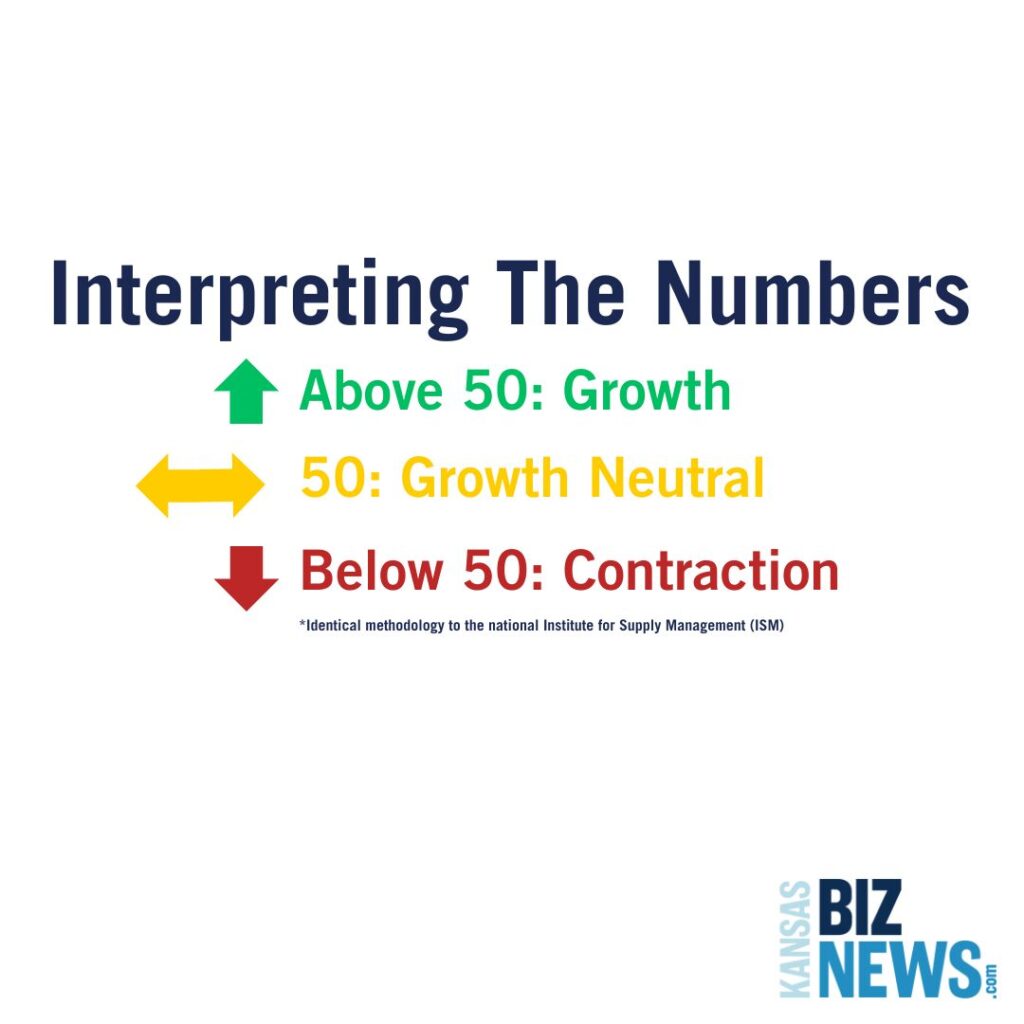

TOPEKA, Kan.- The Kansas Business Conditions Index for April expanded to 51.5 from 45.6 in April according to the monthly Business index compiled by Creighton University.

The index is the average of individual scores measuring new orders, production or sales, delivery lead time, employment, and inventories.

Employment in Kansas measured at 38.8 according to the latest month’s U.S. Bureau of Labor Statistics data. According to the latest month’s U.S. Bureau of Labor Statistics data, involuntary job losses fell by 1,000 or 6.7% over the past 12 months in Kansas.

Other Kansas Indicators

New orders 58.7

Production or sales: 51.6

Delivery lead time: 56.6

Inventories: 51.9

Regional Measurements

After climbing to growth neutral for December, the regional employment gauge tumbled below 50.0 for the past four months. The April employment index fell to 40.0 from March’s 40.9.

“Over the past 12 months, according to the latest monthly U.S. Bureau of Labor and Statistics data, the number of discharges and layoffs in the region soared by 24.5%, or 35,000 job involuntary separations over the 12 months,” said Ernie Goss, professor of economics at Creighton University.

“Despite labor shortages and elevated inflationary pressures, supply managers reported a 12-month wage gain of only 3.5%, or less than inflation over the same period of time,” said Goss.

The April price gauge slipped to a still too high 76.0 from 77.3 in March. Supply managers expect input prices to expand by 5.3% over the next six months.

“The regional inflation yardstick has moved into a range indicating elevated inflationary pressures and points to price growth well above the Fed’s target for half of 2024,” said Goss.

Looking ahead six months, economic optimism as captured by the April Business Confidence index sank to 32.0, its lowest level since January 2024, and down from 41.0 in March. “Approximately 45% of supply managers expect worsening business conditions over the next six months. However, this is an improvement from March’s 68% that expected economic deterioration,” said Goss.

The overall index has fallen below growth neutral for three of the past four months.

The MidAmerica Region includes Kansas, Arkansas, Iowa, Minnesota, Nebraska, North Dakota, Oklahoma, South Dakota, and Missouri.