The 2023 Kansas Competitiveness Blue Book compares data-driven information on the state’s economic health to the rest of the country on how it performs in a number of key indicators.

A project of the Kansas Chamber Education Foundation, Kansans are encouraged to use the Blue Book as a resource as we work together to remove barriers to our state’s business and economic success to increase prosperity for all Kansans.

This spotlight on how Kansas competes in Taxation is the seventh of a series of eight spotlights.

Spotlight on Taxation

When we lower the tax burden, we reduce the cost of doing business in Kansas and encourage economic investment and growth.

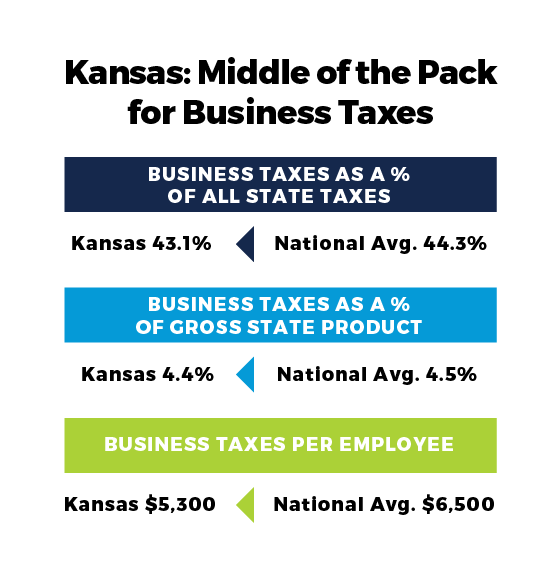

Kansas Business Taxes Are Middle of the Road Compared to Other States

Blue Book data point: Kansas business taxes are slightly lower than the national average when looking at business taxes as a percentage of all state taxes (43.1% vs. 44.3% national average) and as a percentage of gross state product (4.4% vs. 4.5% national average). Kansas rates well on business taxes per employee ($5,300 vs. $6,500 national average)1; however, in the Tax Foundation’s 2023 State Business Tax Climate Index, Kansas overall dropped from 24th in the nation to 25th. (1 is best; 50 is worst.)

Why it matters: The drop in the state’s State Business Tax Climate Index ranking shows why Kansas can’t stand still on its tax policy. Other states continue to make changes to their state tax codes to be more competitive nationally and globally.

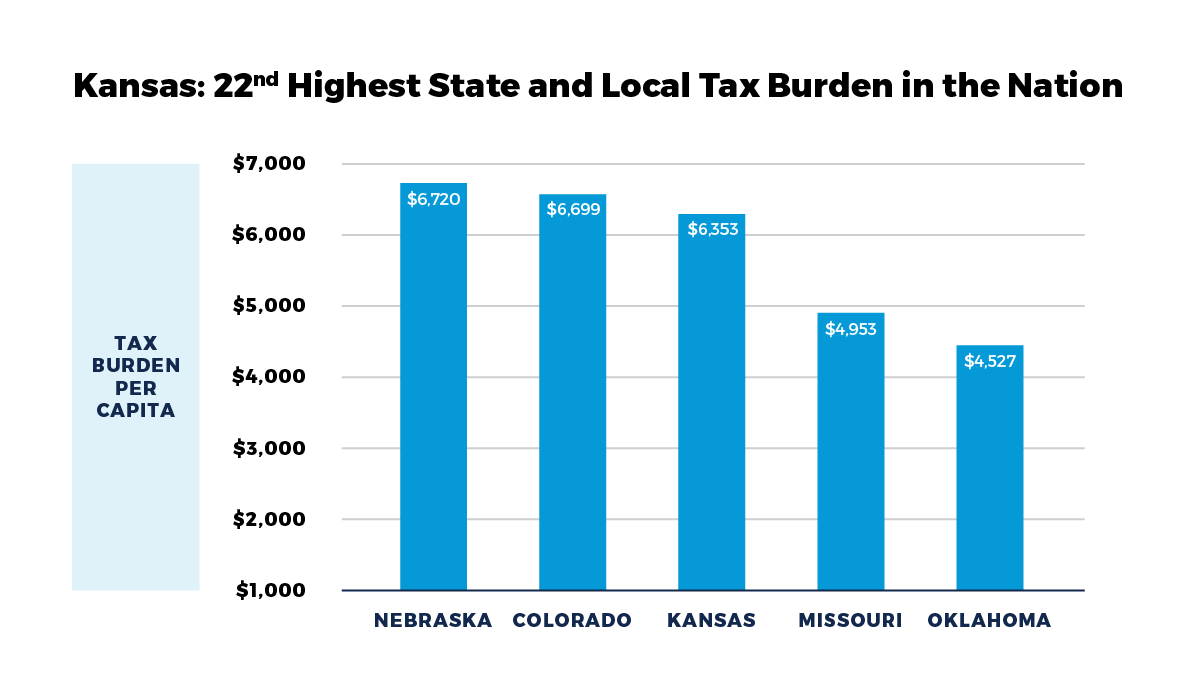

State and Local Taxes Are Higher in Kansas Than in 28 Other States

Blue Book data point: At $6,353 per person, Kansas has the 22nd highest state and local tax burden in the nation.2

Why it matters: Our state and local taxes are significantly higher than those paid by our neighbors in Missouri and Oklahoma, leading some to move to the other side of the state border.

Property Taxes in Kansas Run Average to High, Depending on the Type of Property

Blue Book data point: When comparing effective tax rates in each state’s largest city (in our case Wichita), Kansas has the 12th highest effective tax rate on commercial property; 25th highest effective tax rate on an industrial property; and 27th highest effective property tax rate on a primary residence.3

Why it matters: Commercial and industrial properties often attract jobs and investment from out of state. If Kansas overtaxes those properties relative to other states, capital and jobs are more likely to flow elsewhere.

Takeaway

Tax revenues continue to push Kansas’ annual receipts to record levels. Now is the time to reduce personal and corporate income taxes to position our state to be regionally competitive and to allow small businesses to use more of their revenue for employees and capital investments.

Data Sources

1 Council on State Taxation: State & Local Business Taxes Report

2 Tax Foundation

Click here to read more about how Kansas competes in the 2023 Blue Book.